Overview

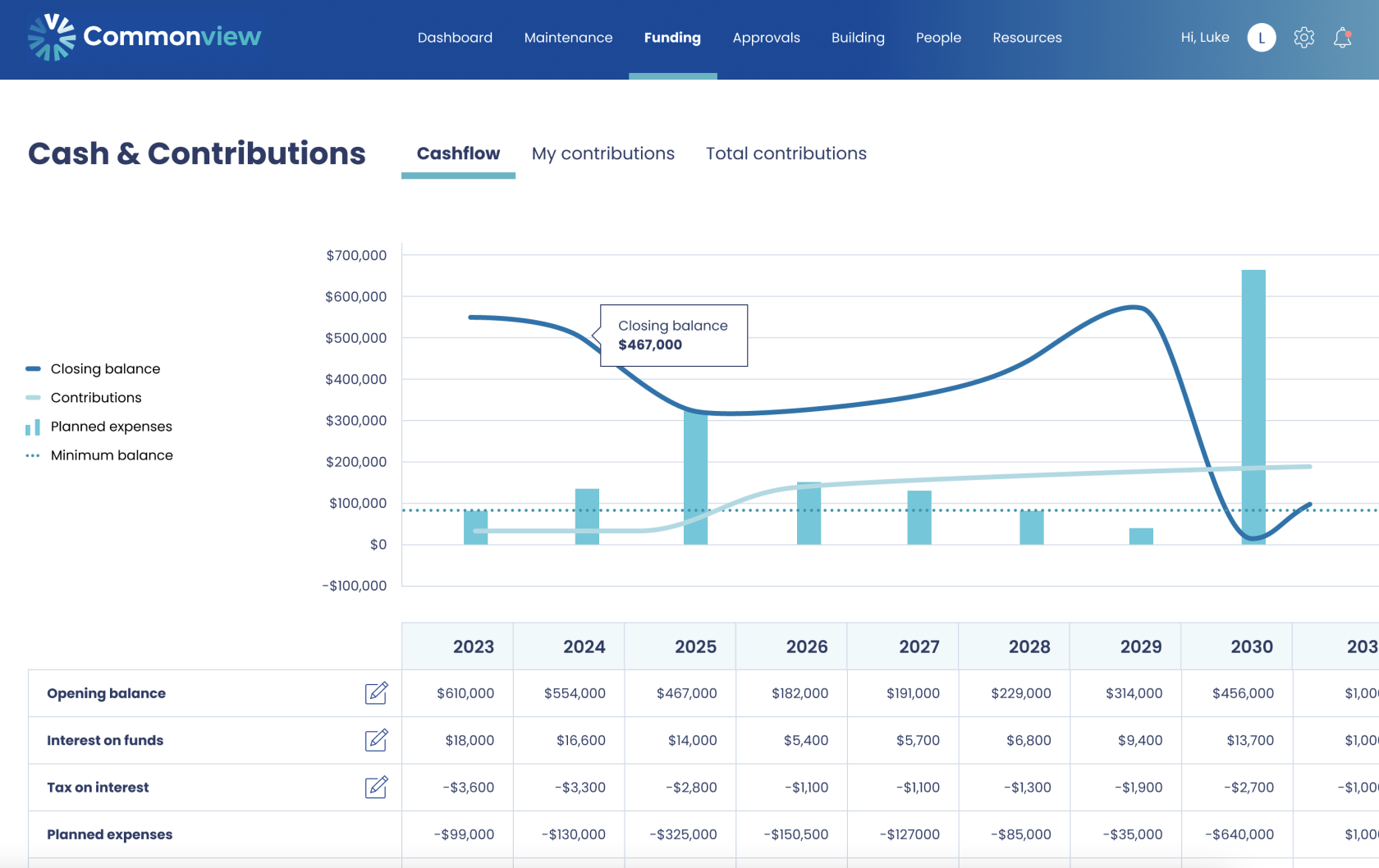

The Cashflow Page displays a complete overview of your maintenance fund over the next 30 years.

It helps you track the health of your fund, see projected balances, and plan contributions to ensure your maintenance activities are always covered.

The page shows the data in two ways:

-

A chart to visualise trends over time.

-

A table showing detailed numbers for each year.

Table Layout

The table columns represent years (aligned with your financial year settings).

The rows represent the main components of your fund:

-

Opening Balance – the balance at the start of the year

-

Interest on Funds – interest earned on the opening balance

-

Tax on Interest – corporate tax applied to interest earned

-

Fees and Charges – bank fees or administrative charges

-

Planned Expenses – projected maintenance costs for the year

-

Contribution Adjustments – manual adjustments to contributions, if any

-

Contributions – funds added to cover planned expenses

-

Closing Balance – the balance at the end of the year

How contributions are calculated

The contributions row is calculated based on the provisions (accruals) from planned expenses and other factors.

-

Start with accruals – the total amount needed for planned expenses in a given year.

-

Adjust for fund earnings and charges:

-

Subtract net interest (interest earned minus taxes)

-

Add fees and charges

-

Add any contribution adjustments

-

This gives the required contribution for that year.

Contributions = (Interest on Funds − Tax on Interest) + Fees and Charges + Contribution Adjustments

How the closing balance is calculated

Closing Balance = Opening Balance − Planned Expenses + Contributions

This ensures that your fund always has enough to cover planned maintenance while taking into account interest, taxes, fees, and adjustments.

Notes

-

The Cashflow Page does not show accruals directly — it only shows the resulting contributions.

-

The chart provides a visual overview of opening and closing balances, helping you quickly identify potential shortfalls or surpluses.

-

All numbers are projected based on your current settings, including inflation, interest rate, tax rate, and forecast opening balance.