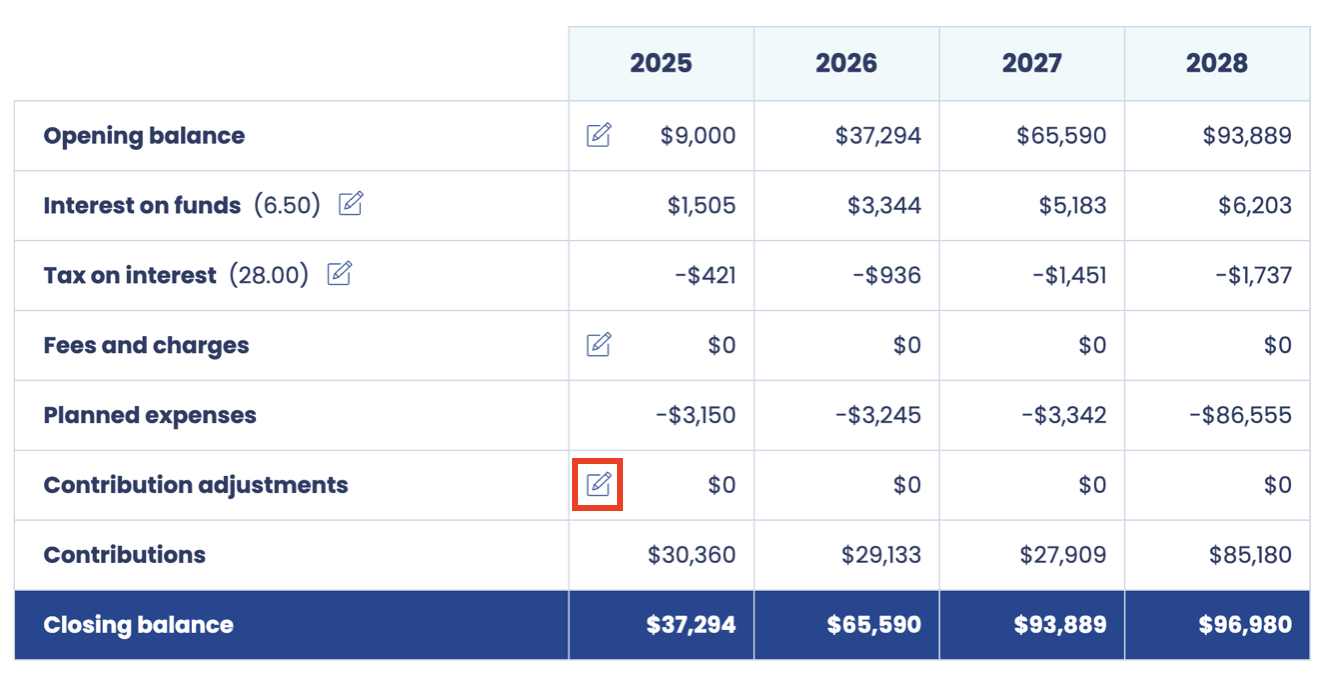

Adjust contributions

The Contribution Adjustments row allows you to manually modify the amount of money added to the maintenance fund for a given year.

This gives you flexibility to account for real-world circumstances that may not be fully captured by the system’s automatic calculations.

How to adjust contributions

-

Click the edit button in the cell for the year you want to adjust.

-

Enter the desired contribution adjustment amount.

-

The system will recalculate the closing balance for the year using your adjusted contribution.

Why you might adjust contributions

You may want to manually adjust contributions for several reasons:

-

Cashflow considerations

-

If contributions are unusually high for a particular year, you may want to spread the cost over multiple years to avoid asking owners for too much at once.

-

-

Fund balance deviations

-

If the fund is higher or lower than expected due to external factors, such as:

-

Inflation being higher or lower than projected

-

Contingency allowance being too low or too high

-

Unexpected maintenance costs or delays

-

-

-

Smoothing contributions

-

To avoid large spikes or dips in contributions across years, you may want to even out the contributions over multiple periods.

-

-

Strategic planning

-

Adjustments can be used to align the maintenance plan with long-term organisational goals, such as preferring a larger buffer in early years or reducing contributions temporarily to free up capital.

-

Key points

-

Adjustments only affect the year you change and the closing balance for that year.

-

Future contributions are not automatically changed unless you adjust them separately.

-

Manual adjustments are fully compatible with the system’s automatic calculations.

Example

| Year | Accruals | Net Interest | Fees | Contribution Adjustments | Contributions |

|---|---|---|---|---|---|

| 2025 | $5,000 | $734 | $50 | -$500 | $3,815 |

-

In this example, the system initially calculated contributions of $4,315.

-

The user reduced the contribution by $500 to account for cashflow constraints.

-

The closing balance and subsequent years’ calculations will reflect this adjustment.